The real threat to Louisiana's future (and it's not crime)

Why we need to do more than just give insurance companies whatever they want, and the right wing is back with another book-banning bill

Listen to Gov. Jeff Landry, and you’d think there’s nothing that threatens Louisiana’s future more than rampant, rising violent crime. But Landry traffics in fear, not facts. Not only is crime falling fast across the state, it’s not even close to being our worst threat.

The biggest threat to Louisiana is a category-five hurricane striking the state’s coast this year or next, one that could wreak enough havoc to tip the state’s beleaguered homeowner’s insurance market into collapse.

That’s the existential threat to Louisiana that many of our top state leaders cannot muster the courage to face. So far, the only sustained, substantive response to the potential of a cataclysmic implosion of the homeowners’ insurance market is to accede to the insurance companies’ demands. Mostly, that means letting them charge us whatever they want and raise rates as often as they wish.

In an op-ed on Friday in the Baton Rouge Advocate, state Insurance Commissioner Tim Temple summarized his ideas for addressing the home insurance crisis:

Our regulatory changes provide clearer guidance to both insurers and their consumers concerning how the department interprets and enforces laws and regulations; reduce fines for insurers that self-report and address minor violations; and allow insurers more autonomy in rate adjustments to better manage risk.

Ben Riggs, executive director of Real Reform Louisiana, rightly argues that Temple’s proposals amount to “stacking the deck in favor of big insurance.”

In his op-ed, even Temple seems to acknowledge that with craftily worded language that obscures what he proposes. “Louisiana is the only state where insurers cannot modify policies to manage their risk effectively,” Temple wrote. “The three-year rule is a red flag for insurers considering Louisiana. Eliminating it shows we are serious about reforming our market.”

Translation: We must allow insurance companies to charge us whatever they want.

If I were a former insurance company executive elected with the contributions of insurance companies, I’d see the world as Temple does. But his job is representing us, not the companies he once worked for. Instead, as Riggs told the Lake Charles American Press, Temple’s plan is “a green light to build in much larger profits and weaken or abolish consumer protections.”

Then there’s the deplorable behavior and financial mismanagement by insurance companies that Temple, a former insurance industry executive, and others seemingly wish to ignore or reward. Advocate reporter Sam Karlin’s revealing four-part series on insurance company malpractice is available at this link.

This is the key finding of Karlin’s reporting:

In 2019 and 2020, 10 of the companies that went belly-up sent a net of nearly $650 million to less-regulated affiliates, according to an analysis by The Times-Picayune | The Advocate. Over the same span, the insurance companies themselves posted a net loss of $440 million.

Several close observers of the insurance industry said there is a key reason to arrange an insurance company this way: To extract profits with less scrutiny. While insurers must routinely open their books to state regulators, that’s not true of their affiliates. That makes it nearly impossible to tell whether the money paid to them was well-spent — or how much of it went to the company’s principals or its investors.

Surely, there is more Louisiana’s leaders can do besides creating a lightly regulated environment in which these companies and others like them can charge customers whatever they want.

Laws like these will be great for insurance companies but devastating to policyholders, especially those with claims after a disaster.

Temple does have at least one decent idea: He supports expanding a program created by his predecessor that helps homeowners in the most vulnerable parishes fortify their roofs.

This approach has worked in Alabama. As reported by WWNO’s Coastal Desk:

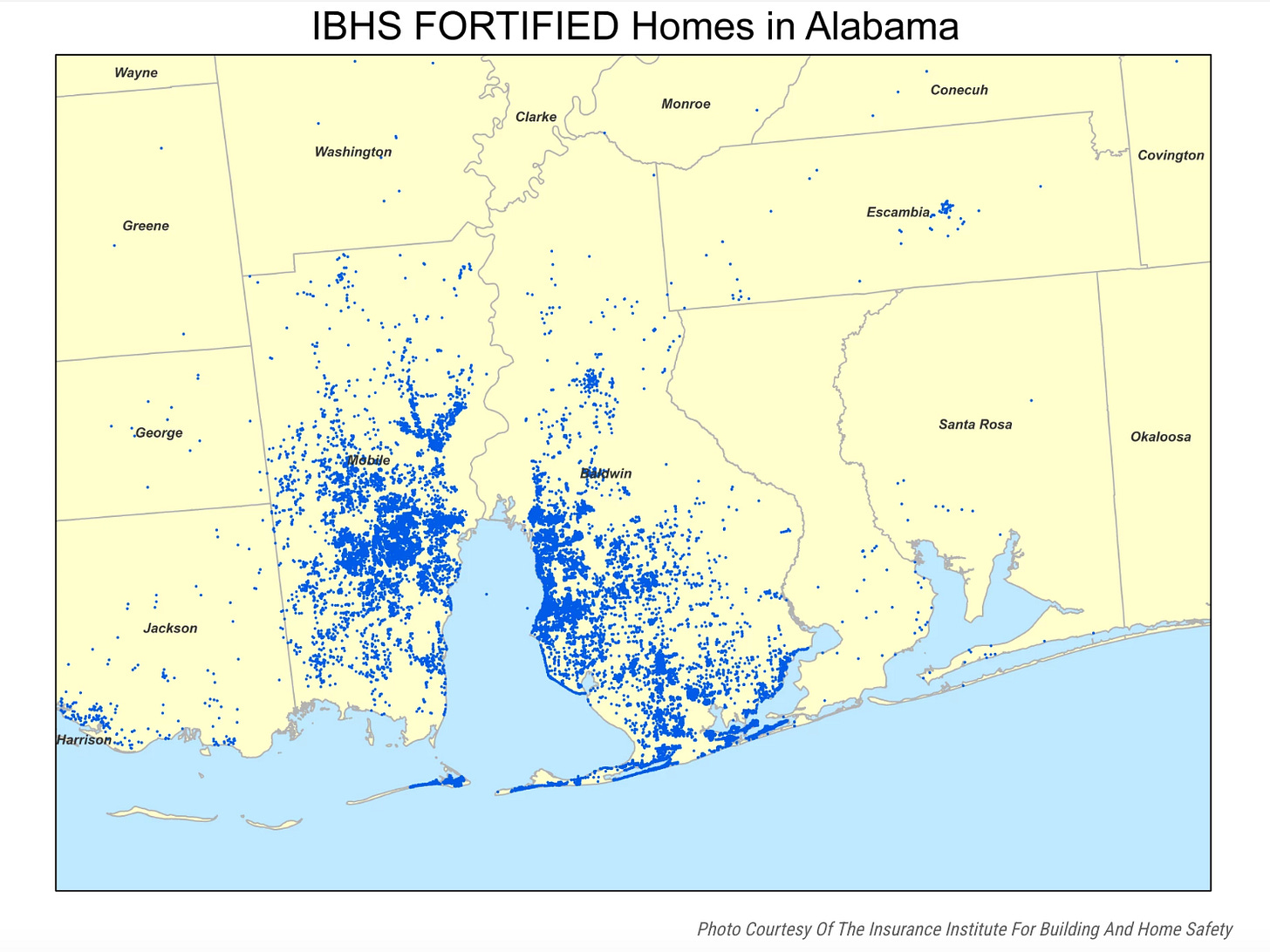

Alabama leads the United States in this kind of construction, hosting about 80% of the nation’s 50,000 FORTIFIED homes. Most are concentrated in its two coastal counties, Mobile and Baldwin.

Alabama has achieved this benchmark thanks, in part, to a state program called Strengthen Alabama Homes. It gives people grants — up to $10,000 each — to help retrofit their homes to the FORTIFIED standard. Other states, like Louisiana, have begun looking to it as a model for incentivizing homeowners to stormproof their homes. . . .

When Strengthen Alabama Homes first got started, it served the state’s two coastal counties. Now, the program has expanded inland. About half of the program’s grants go to homeowners along the coast, and the rest go to residents in the central and northern parts of the state where tornadoes are common.

The grants are funded by fees paid by the insurance industry, not from the state’s general budget — a move state lawmakers approved back in 2015. Powell said it’s a win for the insurance companies too, because houses built to withstand severe weather mean fewer post-storm payouts.

And in recent years, [Brian Powell, director of the Mitigation Resources Division at the Alabama Department of Insurance] said the insurance market on the coast has rebounded.

“The market’s becoming very healthy down there. So it’s been an overwhelming success,” he said.

As in Alabama, Louisiana’s version of this program grants eligible homeowners up to $10,000 to fortify their roofs. However, Louisiana’s commitment to Louisiana Fortify Homes is tentative compared to the Alabama effort, especially considering our risk.

Last year, the $30 million allotted to Louisiana’s program resulted in only 2,500 roof fortifications.

Keep reading with a 7-day free trial

Subscribe to Something Like the Truth: By Robert Mann to keep reading this post and get 7 days of free access to the full post archives.